Privacy Policy for marketshareanalysis.blogspot.com

If you require any more information or have any questions about our privacy policy, please feel free to contact us by email at klantingijo@gmail.com.

At marketshareanalysis.blogspot.com, the privacy of our visitors is of extreme importance to us. This privacy policy document outlines the types of personal information is received and collected by marketshareanalysis.blogspot.com and how it is used.

Log Files

Like many other Web sites, marketshareanalysis.blogspot.com makes use of log files. The information inside the log files includes internet protocol ( IP ) addresses, type of browser, Internet Service Provider ( ISP ), date/time stamp, referring/exit pages, and number of clicks to analyze trends, administer the site, track user’s movement around the site, and gather demographic information. IP addresses, and other such information are not linked to any information that is personally identifiable.

Cookies and Web Beacons

marketshareanalysis.blogspot.com does use cookies to store information about visitors preferences, record user-specific information on which pages the user access or visit, customize Web page content based on visitors browser type or other information that the visitor sends via their browser.

DoubleClick DART Cookie

.:: Google, as a third party vendor, uses cookies to serve ads on marketshareanalysis.blogspot.com.

.:: Google's use of the DART cookie enables it to serve ads to users based on their visit to marketshareanalysis.blogspot.com and other sites on the Internet.

.:: Users may opt out of the use of the DART cookie by visiting the Google ad and content network privacy policy at the following URL - http://www.google.com/privacy_ads.html

Some of our advertising partners may use cookies and web beacons on our site. Our advertising partners include ....

Google Adsense

These third-party ad servers or ad networks use technology to the advertisements and links that appear on marketshareanalysis.blogspot.com send directly to your browsers. They automatically receive your IP address when this occurs. Other technologies ( such as cookies, JavaScript, or Web Beacons ) may also be used by the third-party ad networks to measure the effectiveness of their advertisements and / or to personalize the advertising content that you see.

marketshareanalysis.blogspot.com has no access to or control over these cookies that are used by third-party advertisers.

You should consult the respective privacy policies of these third-party ad servers for more detailed information on their practices as well as for instructions about how to opt-out of certain practices. marketshareanalysis.blogspot.com's privacy policy does not apply to, and we cannot control the activities of, such other advertisers or web sites.

If you wish to disable cookies, you may do so through your individual browser options. More detailed information about cookie management with specific web browsers can be found at the browsers' respective websites.

Monday, August 9, 2010

Market Share within OPEC

A major key to understanding why OPEC does not always do what seems obvious to the rest of us is the battle for market share within OPEC. To examine this we start with an overview of OPEC's history. The graph below shows average daily production by country for each of the current members of OPEC.The graph shows discontinuities in the production of Iraq, Iran and Kuwait. The first two are the result of the Iraq - Iran conflicts in 1979 and 1980. The third discontinuity, in 1990, was the result of Iraq's invasion of Kuwait and the ensuing Gulf War.

Recall the history of OPEC following Arab Oil embargo which started October 19-20, 1973 and ended March 18, 1974. During that period the price for benchmark Saudi Light increased from $2.59 in September 1973 to $11.65 in March. OPEC was setting benchmark prices for its various crudes.

By 1981 the effects of seven years of increased prices had had taken its toll on demand in the form of more energy efficient homes, industrial process, and in substantial increases in automobile gasoline mileage. At the same time crude oil production was increasing in the rest of the world. OPEC's total production stayed relatively constant during this period around 30 million barrels per day. However, OPEC's market share was decreased from over 50 percent in 1974 to 47 percent in 1979. The loss of market share was caused by production increases in the rest of the world. Higher crude prices had made exploration more profitable for everyone not just OPEC and many rushed to take advantage of it.

The rapid price increases of 1979 and 1980 served to accelerate consumer's moves toward efficiency. They also fueled an increased non OPEC production. This was compounded by the deregulation of domestic crude oil prices in the United States. U.S. producers experienced the effects of increases in world prices plus the additional increase brought on by price deregulation.

Demand had peaked in 1979 and it became clear that the only way to for OPEC to maintain prices was by reducing OPEC production. OPEC reduced its total production by a third during the first half of the 1980s. As a result OPEC's share in world oil production dropped below 30 percent.

Members Share within OPEC

At this point it is appropriate to look at some of the detail. The graph to the right shows each OPEC member's share of total OPEC production. It is important to note that we are now looking at OPEC member's share within OPEC and not their share of total world production. Saudi Arabia acted as swing producer for OPEC during the first half of the 1980s in an attempt to shore up declining prices. By 1986 the Saudis tired of this role. Other OPEC member countries were cheating on their quotas. In response Saudi Arabia rapidly increased production causing a major price collapse.

It was almost three years before prices began to recover. The lower prices did have a positive result for OPEC. It encouraged increased consumption and halted production increases in much of the rest of the world. By the end of the decade of the 1980s OPEC and prices seemed to have stabilized.

We now come to the events that led to the current problems for OPEC. Remember when looking at this problem that OPEC or any other cartel faces two problems in their attempts to control prices. The first problem is to determine the level of production which meets their collective goals. Simply stated, for OPEC this means maintaining production levels which insure the highest prices possible without encouraging competition outside of OPEC or significant conservation measures on the part of consumers.

In January of 1990 Saudi Arabia and Kuwait had 24 and 9 percent of OPEC's total production. Iraq and Iran had 13 percent and 12 percent respectively. Iraq was involved at this time in a territorial dispute with Kuwait. Negotiations between the two countries were not successful. A meeting on July 25, 1990 between Saddam Hussein and April Glaspie, United States Ambassador to Iraq, was a major factor in Iraq's decision to invade its neighbor. In that meeting Hussein was assured that the United States would not become involved in the dispute. A week later on August 2, 1990 Iraq invaded and occupied Kuwait.

The United States did get involved and was the major player in restoring Kuwait's sovereignty and early in 1991. At this point Iraq can not longer export and Kuwait's oil fields are devastated. Iraq and Kuwait have virtually no production and the slack is taken up by other OPEC members, primarily Saudi Arabia. In February 1991 Saudi Arabia's production accounted for over 35 percent of OPEC output. The Saudis had increased production sufficiently to compensate for the loss of Kuwait's production as well as some of that of Iraq. Other countries made up most of the difference.

We now come to the current situation. In December 1998 Saudi Arabia's market share was 29.7 percent, Kuwait 7.4 percent, Iran 13.0 percent, Iraq 8.4 percent and Venezuela 11.0 percent. Saudi Arabia has the greatest increase in market share compared to the pre Gulf War period. Venezuela is next. In addition the Saudis have always had the largest volume of production. At most times the Saudis produced at least twice as much as the second largest OPEC producer.

Those who have followed OPEC will recall that, especially in the 1980s, many of the negotiations over production quotas included discussions of what was equitable for the member countries. Among the factors considered were population, per capita income and the dependence upon crude oil exports.

By the end of the 1980s most of the problems about who received what share of the pie had been solved. All of the explicit and implicit agreements in place at that time were disrupted by Iraq's invasion of Kuwait and the ensuing Gulf War. It is probable that OPEC will move in the direction pre Gulf War agreements in splitting up the pie and will return to the old method of doing business. Some consideration will have to be given to the economic needs of OPEC members as well as non OPEC members such as Mexico.

Venezuela is a case in point. The country is on its economic knees or worse. In spite of the fact that

Venezuela increased its share of OPEC production significantly over the last decade. It is unlikely in any OPEC agreement that Venezuela would be asked to give up it's gains.

When OPEC agrees on another cutback in production to boost price is not unlikely that Venezuela will not have to share proportionately in that cut. Even if they do they will not be required to give up their gains in market share. There will be a lot of pressure on Saudi Arabia to shoulder a disproportionate share of the cuts.

Recall the history of OPEC following Arab Oil embargo which started October 19-20, 1973 and ended March 18, 1974. During that period the price for benchmark Saudi Light increased from $2.59 in September 1973 to $11.65 in March. OPEC was setting benchmark prices for its various crudes.

By 1981 the effects of seven years of increased prices had had taken its toll on demand in the form of more energy efficient homes, industrial process, and in substantial increases in automobile gasoline mileage. At the same time crude oil production was increasing in the rest of the world. OPEC's total production stayed relatively constant during this period around 30 million barrels per day. However, OPEC's market share was decreased from over 50 percent in 1974 to 47 percent in 1979. The loss of market share was caused by production increases in the rest of the world. Higher crude prices had made exploration more profitable for everyone not just OPEC and many rushed to take advantage of it.

The rapid price increases of 1979 and 1980 served to accelerate consumer's moves toward efficiency. They also fueled an increased non OPEC production. This was compounded by the deregulation of domestic crude oil prices in the United States. U.S. producers experienced the effects of increases in world prices plus the additional increase brought on by price deregulation.

Demand had peaked in 1979 and it became clear that the only way to for OPEC to maintain prices was by reducing OPEC production. OPEC reduced its total production by a third during the first half of the 1980s. As a result OPEC's share in world oil production dropped below 30 percent.

Members Share within OPEC

At this point it is appropriate to look at some of the detail. The graph to the right shows each OPEC member's share of total OPEC production. It is important to note that we are now looking at OPEC member's share within OPEC and not their share of total world production. Saudi Arabia acted as swing producer for OPEC during the first half of the 1980s in an attempt to shore up declining prices. By 1986 the Saudis tired of this role. Other OPEC member countries were cheating on their quotas. In response Saudi Arabia rapidly increased production causing a major price collapse.

It was almost three years before prices began to recover. The lower prices did have a positive result for OPEC. It encouraged increased consumption and halted production increases in much of the rest of the world. By the end of the decade of the 1980s OPEC and prices seemed to have stabilized.

We now come to the events that led to the current problems for OPEC. Remember when looking at this problem that OPEC or any other cartel faces two problems in their attempts to control prices. The first problem is to determine the level of production which meets their collective goals. Simply stated, for OPEC this means maintaining production levels which insure the highest prices possible without encouraging competition outside of OPEC or significant conservation measures on the part of consumers.

In January of 1990 Saudi Arabia and Kuwait had 24 and 9 percent of OPEC's total production. Iraq and Iran had 13 percent and 12 percent respectively. Iraq was involved at this time in a territorial dispute with Kuwait. Negotiations between the two countries were not successful. A meeting on July 25, 1990 between Saddam Hussein and April Glaspie, United States Ambassador to Iraq, was a major factor in Iraq's decision to invade its neighbor. In that meeting Hussein was assured that the United States would not become involved in the dispute. A week later on August 2, 1990 Iraq invaded and occupied Kuwait.

The United States did get involved and was the major player in restoring Kuwait's sovereignty and early in 1991. At this point Iraq can not longer export and Kuwait's oil fields are devastated. Iraq and Kuwait have virtually no production and the slack is taken up by other OPEC members, primarily Saudi Arabia. In February 1991 Saudi Arabia's production accounted for over 35 percent of OPEC output. The Saudis had increased production sufficiently to compensate for the loss of Kuwait's production as well as some of that of Iraq. Other countries made up most of the difference.

We now come to the current situation. In December 1998 Saudi Arabia's market share was 29.7 percent, Kuwait 7.4 percent, Iran 13.0 percent, Iraq 8.4 percent and Venezuela 11.0 percent. Saudi Arabia has the greatest increase in market share compared to the pre Gulf War period. Venezuela is next. In addition the Saudis have always had the largest volume of production. At most times the Saudis produced at least twice as much as the second largest OPEC producer.

Those who have followed OPEC will recall that, especially in the 1980s, many of the negotiations over production quotas included discussions of what was equitable for the member countries. Among the factors considered were population, per capita income and the dependence upon crude oil exports.

By the end of the 1980s most of the problems about who received what share of the pie had been solved. All of the explicit and implicit agreements in place at that time were disrupted by Iraq's invasion of Kuwait and the ensuing Gulf War. It is probable that OPEC will move in the direction pre Gulf War agreements in splitting up the pie and will return to the old method of doing business. Some consideration will have to be given to the economic needs of OPEC members as well as non OPEC members such as Mexico.

Venezuela is a case in point. The country is on its economic knees or worse. In spite of the fact that

Venezuela increased its share of OPEC production significantly over the last decade. It is unlikely in any OPEC agreement that Venezuela would be asked to give up it's gains.

When OPEC agrees on another cutback in production to boost price is not unlikely that Venezuela will not have to share proportionately in that cut. Even if they do they will not be required to give up their gains in market share. There will be a lot of pressure on Saudi Arabia to shoulder a disproportionate share of the cuts.

Statistics show Firefox 3 spreading fast

Firefox 3 is spreading fast, claiming more than 4 percent of the share of Web browser usage less than 24 hours after its release.

According to Net Applications, which monitors browser usage at major Web sites, Firefox 3 rapidly ascended to what I'd call force-to-be-reckoned-with status, something Web designers shouldn't be ignoring. For comparison, Apple's Safari had 6.25 percent share in May, and Opera had 0.71 percent.

Undoubtedly, most Firefox 3 activity is from existing Firefox users, but it's still a notable achievement, given that software companies constantly struggle to get users to adopt the latest products.

Mozilla, which sponsors and oversees development of the open-source Web browser, released Firefox 3 for download on Tuesday. It primed the publicity pump with an effort to set a 24-hour download record, and interest by the abundant Firefox loyalists brought Mozilla's servers to their knees for nearly two hours Wednesday.

Mozilla has been fulfilling pent-up demand ever since. Sometime after 7 a.m. PDT, downloads crossed the 7 million mark, according to Mozilla's download counter, which is fun to watch, even though it's badly formatted.

The download rate, which peaked at 14,000 per minute Tuesday, was about 6,600 per minute Wednesday morning.

For full coverage, including reviews and videos, see CNET's Firefox 3 resource center.

According to Net Applications, which monitors browser usage at major Web sites, Firefox 3 rapidly ascended to what I'd call force-to-be-reckoned-with status, something Web designers shouldn't be ignoring. For comparison, Apple's Safari had 6.25 percent share in May, and Opera had 0.71 percent.

Undoubtedly, most Firefox 3 activity is from existing Firefox users, but it's still a notable achievement, given that software companies constantly struggle to get users to adopt the latest products.

Mozilla, which sponsors and oversees development of the open-source Web browser, released Firefox 3 for download on Tuesday. It primed the publicity pump with an effort to set a 24-hour download record, and interest by the abundant Firefox loyalists brought Mozilla's servers to their knees for nearly two hours Wednesday.

Mozilla has been fulfilling pent-up demand ever since. Sometime after 7 a.m. PDT, downloads crossed the 7 million mark, according to Mozilla's download counter, which is fun to watch, even though it's badly formatted.

The download rate, which peaked at 14,000 per minute Tuesday, was about 6,600 per minute Wednesday morning.

For full coverage, including reviews and videos, see CNET's Firefox 3 resource center.

February Search Market Share: Google bounces back from a market share slowdown, but in a down month

With only 28 days, February is typically a low-query month for the leading search engines. This year proved no exception, with query volumes dipping across the board, despite searcher interest in the Oscars and Valentine’s Day.One interesting result of this dip in query volume was that it actually improved Google’s market share. So while Google’s query volume fell by 1%, its market share actually rose 2.2pts. That move effectively reversed a long term trend we’ve seen with Google’s market share over the past 6 months. Since August 2008, Google’s market share has hovered at 70%. Last month, it hit 72.4%.

While Google benefitted from a down month in its industry, others did not fare so well.

Yahoo! lost 1.5pts market share on 11.6% decline in query volume. It hit a new market share low of 17.8% last month.

MSN/Live also declined 0.4pts and hit a market share low of 6.3% of search queries. Factoring in Club Live, MSN fared somewhat better but still lost share.

Ask also lost both query volume and market share. For the past 6 months, Ask’s share has hovered around 2.5%.

In February, Ask managed to increase Sponsored Referrals, or the rate of referrals that drive advertising revenue, by 46% to 6.2% of all referrals. That brought Ask in line with Google and Yahoo!, which have maintained Sponsored Referrals at 6 – 9% over the past year.

The key points for February, 2009 (excluding Club Live from the market)…

Google query volume dipped 1% but market share actually rose to 72.4% on a down market, reversing a share slowdown.

Yahoo! fell to 17.8% market share, a new low. Query volume also declined due to the shortened month.

MSN/Live also fell to a new low of 6.3% market share, with a similar query decline.

Ask maintained 2.3% share, but Sponsored Referrals rose to a healthy 6.2%.

AOL held on with 0.8% share. We’ll see if new CEO Tim Armstrong can bring some of that Google magic.

While Google benefitted from a down month in its industry, others did not fare so well.

Yahoo! lost 1.5pts market share on 11.6% decline in query volume. It hit a new market share low of 17.8% last month.

MSN/Live also declined 0.4pts and hit a market share low of 6.3% of search queries. Factoring in Club Live, MSN fared somewhat better but still lost share.

Ask also lost both query volume and market share. For the past 6 months, Ask’s share has hovered around 2.5%.

In February, Ask managed to increase Sponsored Referrals, or the rate of referrals that drive advertising revenue, by 46% to 6.2% of all referrals. That brought Ask in line with Google and Yahoo!, which have maintained Sponsored Referrals at 6 – 9% over the past year.

The key points for February, 2009 (excluding Club Live from the market)…

Google query volume dipped 1% but market share actually rose to 72.4% on a down market, reversing a share slowdown.

Yahoo! fell to 17.8% market share, a new low. Query volume also declined due to the shortened month.

MSN/Live also fell to a new low of 6.3% market share, with a similar query decline.

Ask maintained 2.3% share, but Sponsored Referrals rose to a healthy 6.2%.

AOL held on with 0.8% share. We’ll see if new CEO Tim Armstrong can bring some of that Google magic.

2nd quarter of 2008 proves fruitful for global mobile device market

Unlike the first quarter 2008, second quarter of this year proves to be beneficial for the mobile phone vendors worldwide. According to the research firm, ABI 301 million units are transported in this quarter. It reaffirms the positive prospects of the global device market providing 13% growth in 2008 and mark the shipment to touch 1.3 billion mobile units.

Despite the downturn of world economy, the tier one vendors handset shipment growth between 15 and 22 per cent. Delete the woes of inflation, consumers in emerging markets in Asia, Africa, South America and the Middle East a bold sign of smart mobile phones. According to Jake Saunders, ABI Research president, "If there is economic slowdown, no one bothered to tell the mobile device buying public. The healthy gains in net subscriber additions are stimulating new and upgrade sales. In buy a handset developed markets tend to be flat, but those consumers who bought dig deeper and pay more for higher-end sets and distinctive smart-phones. "Despite the turbulence in the global economy market attraction mass with having the latest and greatest handset shows no sign of weakening.

Nokia continues to be the undisputed leader in the handset market. For the first time that Nokia surpassed the 40% market share. Samsung was far behind in second with 15.2% share. Motorola and LG are too close together. Motorola's share is 9.3%, slightly ahead of LG at 9.2%. maybe at the end of the third quarter of 2008 lg take over Motorola. Sony Ericsson in fifth place with the market share of 8.3%.

Nokia has been continuously refreshing its portfolio in the high-end, mid-tier categories and the ultra-low cost handset market. Nokia’s overall market share is likely to hold.

Despite the downturn of world economy, the tier one vendors handset shipment growth between 15 and 22 per cent. Delete the woes of inflation, consumers in emerging markets in Asia, Africa, South America and the Middle East a bold sign of smart mobile phones. According to Jake Saunders, ABI Research president, "If there is economic slowdown, no one bothered to tell the mobile device buying public. The healthy gains in net subscriber additions are stimulating new and upgrade sales. In buy a handset developed markets tend to be flat, but those consumers who bought dig deeper and pay more for higher-end sets and distinctive smart-phones. "Despite the turbulence in the global economy market attraction mass with having the latest and greatest handset shows no sign of weakening.

Nokia continues to be the undisputed leader in the handset market. For the first time that Nokia surpassed the 40% market share. Samsung was far behind in second with 15.2% share. Motorola and LG are too close together. Motorola's share is 9.3%, slightly ahead of LG at 9.2%. maybe at the end of the third quarter of 2008 lg take over Motorola. Sony Ericsson in fifth place with the market share of 8.3%.

Nokia has been continuously refreshing its portfolio in the high-end, mid-tier categories and the ultra-low cost handset market. Nokia’s overall market share is likely to hold.

Simmons Market Share By Investment Bank

Giving full credit to all firms involved in a transaction, Simmons’ market share measured by number of transactions is a multiple of that of the closest competitor.

All Energy Service Transactions

January 1993 Through August 2008

(Dollar amounts in billions)

Energy Service Transactions Under $500 Million

(Dollar amounts in billions)

All Energy Service Transactions

January 1993 Through August 2008

(Dollar amounts in billions)

Energy Service Transactions Under $500 Million

(Dollar amounts in billions)

Linux Market Share Passes 1%

NetApplications’ hitslink.com just released their april market share stats and linux passed 1% for the first time ever.

Here is a plot of the linux market share for the past several years based on hitslinks’ stats:

1 in 100 desktops/laptops is now linux according to hitslink. Hurray. While this number may be a low estimate due to linux users visiting different sites or hiding their browser identity, the main thing to take away from this is the trend: up! Over 300% in just a few years.

Here is a plot of the linux market share for the past several years based on hitslinks’ stats:

1 in 100 desktops/laptops is now linux according to hitslink. Hurray. While this number may be a low estimate due to linux users visiting different sites or hiding their browser identity, the main thing to take away from this is the trend: up! Over 300% in just a few years.

Central Europe marketshare situation – short analysis (part 5 / Ukraine)

Ukraine

Population: 46.8 mln

Internet users: 5.3 mln (11.5%)

Ukraine, in contrast to previously described Lithuania, is the biggest of the countries from the group I’m describing now. It’s also the only country that is bilingual. Its situation is so different to other countries that I’ll spend more time describing it before we’ll skip to browsers. Feel free to ignore that part, but you may end up asking yourself why Firefox adoption is so low here.

While, in fact, the only official language of Ukraine is Ukrainian, over 17.3% of the population of Ukraine are Russians. In result, 24% of the population speaks native Russian. Another important factor is a strong demographic difference between the East of Ukraine and the West. The western part of Ukraine is focused on partnership with the European Union, while the eastern part looks at Russia as their strategic partner and there is a strong animosity between them. In result for many Ukrainians, Russian language has strong negative correlation. Of course, such model is oversimplified, but it can make it easier for the reader to understand the complexity of the internal situation in Ukraine. Another interesting factor is that although Ukraine is a poor country by European standards (position 100th on the list of GDP per capita), it produces the fourth biggest number of tertiary graduates in Europe.

Speaking about Gemius numbers, I have to remind you that comparing to other countries from the group, data from Ukraine is a smallest probe with around 400 000 users tracked out of 5.3 mln users of the Internet overall. Yet, I believe that the results are representative for the country’s situation.

I have also three other sources from Ukraine that confirm the results presented below, and it also matches the latest results from XiTi Monitor.

Another important factor is that the 53% of the tracked page hits were from the Kyiv region where the capital of the country is located. It’s to be expected since the Internet connection is very much limited and as you have seen above, only 11.5% of the population uses Internet at all.

Because one of the key factors of the low Internet usage rate are the connection prices, we should expect that the tracked group is richer than average, better educated, with better machines etc. -> if someone can afford Internet connection, he probably can afford a good monitor.

And gemius data confirms that. While the average group of 1280×1024 users in Poland, Czech Rep., Hungary and Lithuania is 18.4%, in Ukrainian group it is 31.9%.

The OS situation is that the market share of Windows Vista is the lowest (of of the group) with just 2.4% while the Linux is the highest (0.6% of the market share comparing to average 0.4%).

So how does the situation look like when it comes down to browser market share?

Totally different!

The highest IE market share – over 63.6%, the lowest for Firefox – just 14.2% and huge market share of Opera browser – 17.6%.

Together, Firefox and Opera have less market share here than Firefox alone in Poland or Hungary!

It looks even worse for Firefox when we split IE to IE7 and IE6:

Fortunately, IE6 is below 50% mark but it’s the strongest IE6 position of the group. Together with the strongest Opera presence (Opera has more market share in Ukraine that in 4 other countries together!) and Firefox owning 15% less than the average, Ukraine is probably one of the most intriguing countries to analyze.

Now, let me give you my explanation of this.

Do you remember which other country has a higher IE7 market share than Firefox’s one? Yes. Lithuania.

And as you may remember from my previous post, Lithuania got Firefox localized 1.5 year after Fx 1.0 release. How does it look for Ukraine?

The very first release of Firefox in Ukrainian happened on November 26th 2007. Less than two months ago! Three years after Firefox 1.0 release!

So we have now 3 countries where Firefox 1.0 was released in local language (Poland, Czech Republic, Hungary), a country where Firefox has been released in local language 1,5 year later, and a country where it has been released another 1,5 year later.

What conclusions can we draw from this correlation from Lithuania and Ukraine?

It seems that Firefox has been released in the perfect moment. Users were tired of IE and were ready to switch. If not to Firefox, they would have started switching to Opera.

Firefox is clearly winning wherever it can be offered in local language

Localization matters a lot in case of Central Europe (we cannot give lack of localization as the reason for poor Fx adoption in Netherlands and United Kingdom)

Opera is a browser that can take bigger than 5-6% market share when Firefox is not available.

Users are switching to IE7 more often, when Opera is an alternative instead of Firefox (compare Vista and IE7 market share in Ukraine), so Firefox is a better competitor when rivaling IE7.

Firefox 2 can grab around 13% of the market share without a localization in the country where English language is not too popular

Let’s take a look at the last 16 weeks and how it has been changing during the timeframe.

During the last 16 weeks, Opera has been gathering market share faster than Firefox. And in result gathered additional 3.4%, while Firefox gained only 1.9%.

This is another chart that looks differently for Ukraine. Opera is on the highroad and is the number one choice for users abandoning blue E. Firefox is not only in a worse position, but it’s also progressing slower.

Another important thing is that, as I wrote in the beginning, 24% of Ukrainians speak Russian as their native language, and almost everyone understands Russian. It means that many Firefox users from Ukraine may be using Russian locale.

So it’s possible that the importance of localization is even higher than these numbers show.

If we split it into versions, we can see IE7 taking a lead, Opera second and Firefox third.

The good news is that it’s gaining users now, because one year ago, during January 2007, Firefox even dropped from 8.7% to 8.1% of the market share in Ukraine.

At the same time, January 2007, Opera had 10.1% of the market share. Currently, Opera 9 has 17.6% and Opera 8 – 1.3% which gives 18.9% totally for 24th of December. (next two weeks bumped Opera to 22.7% this week, but this may be a peak caused by holiday season, we’ll see).

The last chart is a week to week one.

What we can see is a totally different picture to similar graphs from Poland, Hungary, Czech Republic or Lithuania.

During the last 16 weeks there was no clear line trend, and Firefox is currently gaining approximately just below 0.2% per week, while 16 weeks ago it was gaining just below 0.04% per week. At the same time Opera went up from average 0.2% per week to 0.25%.

It means that even now Opera is gaining users faster than Firefox, and while it’s pretty probable that after some time Firefox will reclaim the number two position in Ukraine, Opera is not slowing down yet just because Firefox appeared.

It’s a very interesting case to watch. What will happen? Will Opera keep its trend because of viral marketing of its users? Will Firefox normalize the situation and next year trends will look similar to other countries from this region?

Will this case confirm Lithuanian case that Firefox is a preferred choice once available over Opera or will it show that once Opera has a chance to gather big market share it can compete with Firefox well?

Will strong position of Opera and Firefox result in lower IE usage and better web standards support on the market? What can we learn from the Ukrainian case about the market share situation?

No matter what will happen, I’d like to congratulate and thank the Ukrainian localization team, for their hard work that will make the free open source browser of choice of so many million people available to Ukrainians offering the best experience possible.

I’d like to give credits to Benjamin Smedberg who was leading the internationalization effort for Firefox 1.0 and together with Axel Hecht made the so called “source l10n” possible. Kudos goes to Axel Hecht, who manages the whole localization community of Firefox, ensuring that the browser is localizable and localized to so many languages.

And the biggest, strongest THANK YOU goes to those wonderful, amazing localizers who are a part of this project for over 3 years now making the Mozilla dream possible. It’s an amazing community. Over 200 people from near to 70 localization teams, united under common vision inscribed in the Mozilla Manifesto are involved in each and every Firefox localization release, and this blog post and the data from Ukraine is probably the single clearest proof how important it is for the user experience of Firefox and for the promotion of our mission

Population: 46.8 mln

Internet users: 5.3 mln (11.5%)

Ukraine, in contrast to previously described Lithuania, is the biggest of the countries from the group I’m describing now. It’s also the only country that is bilingual. Its situation is so different to other countries that I’ll spend more time describing it before we’ll skip to browsers. Feel free to ignore that part, but you may end up asking yourself why Firefox adoption is so low here.

While, in fact, the only official language of Ukraine is Ukrainian, over 17.3% of the population of Ukraine are Russians. In result, 24% of the population speaks native Russian. Another important factor is a strong demographic difference between the East of Ukraine and the West. The western part of Ukraine is focused on partnership with the European Union, while the eastern part looks at Russia as their strategic partner and there is a strong animosity between them. In result for many Ukrainians, Russian language has strong negative correlation. Of course, such model is oversimplified, but it can make it easier for the reader to understand the complexity of the internal situation in Ukraine. Another interesting factor is that although Ukraine is a poor country by European standards (position 100th on the list of GDP per capita), it produces the fourth biggest number of tertiary graduates in Europe.

Speaking about Gemius numbers, I have to remind you that comparing to other countries from the group, data from Ukraine is a smallest probe with around 400 000 users tracked out of 5.3 mln users of the Internet overall. Yet, I believe that the results are representative for the country’s situation.

I have also three other sources from Ukraine that confirm the results presented below, and it also matches the latest results from XiTi Monitor.

Another important factor is that the 53% of the tracked page hits were from the Kyiv region where the capital of the country is located. It’s to be expected since the Internet connection is very much limited and as you have seen above, only 11.5% of the population uses Internet at all.

Because one of the key factors of the low Internet usage rate are the connection prices, we should expect that the tracked group is richer than average, better educated, with better machines etc. -> if someone can afford Internet connection, he probably can afford a good monitor.

And gemius data confirms that. While the average group of 1280×1024 users in Poland, Czech Rep., Hungary and Lithuania is 18.4%, in Ukrainian group it is 31.9%.

The OS situation is that the market share of Windows Vista is the lowest (of of the group) with just 2.4% while the Linux is the highest (0.6% of the market share comparing to average 0.4%).

So how does the situation look like when it comes down to browser market share?

Totally different!

The highest IE market share – over 63.6%, the lowest for Firefox – just 14.2% and huge market share of Opera browser – 17.6%.

Together, Firefox and Opera have less market share here than Firefox alone in Poland or Hungary!

It looks even worse for Firefox when we split IE to IE7 and IE6:

Fortunately, IE6 is below 50% mark but it’s the strongest IE6 position of the group. Together with the strongest Opera presence (Opera has more market share in Ukraine that in 4 other countries together!) and Firefox owning 15% less than the average, Ukraine is probably one of the most intriguing countries to analyze.

Now, let me give you my explanation of this.

Do you remember which other country has a higher IE7 market share than Firefox’s one? Yes. Lithuania.

And as you may remember from my previous post, Lithuania got Firefox localized 1.5 year after Fx 1.0 release. How does it look for Ukraine?

The very first release of Firefox in Ukrainian happened on November 26th 2007. Less than two months ago! Three years after Firefox 1.0 release!

So we have now 3 countries where Firefox 1.0 was released in local language (Poland, Czech Republic, Hungary), a country where Firefox has been released in local language 1,5 year later, and a country where it has been released another 1,5 year later.

What conclusions can we draw from this correlation from Lithuania and Ukraine?

It seems that Firefox has been released in the perfect moment. Users were tired of IE and were ready to switch. If not to Firefox, they would have started switching to Opera.

Firefox is clearly winning wherever it can be offered in local language

Localization matters a lot in case of Central Europe (we cannot give lack of localization as the reason for poor Fx adoption in Netherlands and United Kingdom)

Opera is a browser that can take bigger than 5-6% market share when Firefox is not available.

Users are switching to IE7 more often, when Opera is an alternative instead of Firefox (compare Vista and IE7 market share in Ukraine), so Firefox is a better competitor when rivaling IE7.

Firefox 2 can grab around 13% of the market share without a localization in the country where English language is not too popular

Let’s take a look at the last 16 weeks and how it has been changing during the timeframe.

During the last 16 weeks, Opera has been gathering market share faster than Firefox. And in result gathered additional 3.4%, while Firefox gained only 1.9%.

This is another chart that looks differently for Ukraine. Opera is on the highroad and is the number one choice for users abandoning blue E. Firefox is not only in a worse position, but it’s also progressing slower.

Another important thing is that, as I wrote in the beginning, 24% of Ukrainians speak Russian as their native language, and almost everyone understands Russian. It means that many Firefox users from Ukraine may be using Russian locale.

So it’s possible that the importance of localization is even higher than these numbers show.

If we split it into versions, we can see IE7 taking a lead, Opera second and Firefox third.

The good news is that it’s gaining users now, because one year ago, during January 2007, Firefox even dropped from 8.7% to 8.1% of the market share in Ukraine.

At the same time, January 2007, Opera had 10.1% of the market share. Currently, Opera 9 has 17.6% and Opera 8 – 1.3% which gives 18.9% totally for 24th of December. (next two weeks bumped Opera to 22.7% this week, but this may be a peak caused by holiday season, we’ll see).

The last chart is a week to week one.

What we can see is a totally different picture to similar graphs from Poland, Hungary, Czech Republic or Lithuania.

During the last 16 weeks there was no clear line trend, and Firefox is currently gaining approximately just below 0.2% per week, while 16 weeks ago it was gaining just below 0.04% per week. At the same time Opera went up from average 0.2% per week to 0.25%.

It means that even now Opera is gaining users faster than Firefox, and while it’s pretty probable that after some time Firefox will reclaim the number two position in Ukraine, Opera is not slowing down yet just because Firefox appeared.

It’s a very interesting case to watch. What will happen? Will Opera keep its trend because of viral marketing of its users? Will Firefox normalize the situation and next year trends will look similar to other countries from this region?

Will this case confirm Lithuanian case that Firefox is a preferred choice once available over Opera or will it show that once Opera has a chance to gather big market share it can compete with Firefox well?

Will strong position of Opera and Firefox result in lower IE usage and better web standards support on the market? What can we learn from the Ukrainian case about the market share situation?

No matter what will happen, I’d like to congratulate and thank the Ukrainian localization team, for their hard work that will make the free open source browser of choice of so many million people available to Ukrainians offering the best experience possible.

I’d like to give credits to Benjamin Smedberg who was leading the internationalization effort for Firefox 1.0 and together with Axel Hecht made the so called “source l10n” possible. Kudos goes to Axel Hecht, who manages the whole localization community of Firefox, ensuring that the browser is localizable and localized to so many languages.

And the biggest, strongest THANK YOU goes to those wonderful, amazing localizers who are a part of this project for over 3 years now making the Mozilla dream possible. It’s an amazing community. Over 200 people from near to 70 localization teams, united under common vision inscribed in the Mozilla Manifesto are involved in each and every Firefox localization release, and this blog post and the data from Ukraine is probably the single clearest proof how important it is for the user experience of Firefox and for the promotion of our mission

Mac sales outpacing industry 3:1

Mac market share is on the rise, while Dell's isslip-slidingaway.

The proportion of news analysis IDC PC Tracker market yet and it looks like Apple had a strong quarter with plenty of growth.

IDC reports that U.S. PC shipments grew 7.2% in Q2 2007 while Mac loads increase of 26.2% over the year-on-year. Like it or not, making Apple the biggest seller 4 unit shipments with 5.6 per cent of (the U.S. market Apple's share the same time last year was 4.8%.) 5.6% of ' The market gives Apple ahead of other big names like Toshiba and Acer quintile.

While Dell took the number one spot with shipments of 4.8 million computers in the quarter, unit shipments was down nearly 11 percent year-on-year.

Gateway was (not sold in Australia) number three on the list, but also decreased 7 per cent. Better news comes from Apple HP nearly corresponds with an increase of 26% growth in shipments year-on-year.

overall growth of the global PC market was 12.5 percent.

Apple will reveal its numbers on 25 July at its quarterly earnings conference call. In addition to selling releasing Mac unit sales should also be discussing the iPhone for two days last June.

No matter how you slice it, these numbers are good news for the Mac fraternity who have been somewhat concerned about the last few years can be turned Apple into a music company more money than (the fact that fuel reduced computer company Apple "Computer" from its name recently, deciding to go with "Apple Inc" instead).

However, with computer sales growth of over three times the market Apple is being shared.

What makes these numbers even more impressive is the fact that all the other PC vendors in the vending machines at the site much more different price points than Apple offers. With the iPhone too

The proportion of news analysis IDC PC Tracker market yet and it looks like Apple had a strong quarter with plenty of growth.

IDC reports that U.S. PC shipments grew 7.2% in Q2 2007 while Mac loads increase of 26.2% over the year-on-year. Like it or not, making Apple the biggest seller 4 unit shipments with 5.6 per cent of (the U.S. market Apple's share the same time last year was 4.8%.) 5.6% of ' The market gives Apple ahead of other big names like Toshiba and Acer quintile.

While Dell took the number one spot with shipments of 4.8 million computers in the quarter, unit shipments was down nearly 11 percent year-on-year.

Gateway was (not sold in Australia) number three on the list, but also decreased 7 per cent. Better news comes from Apple HP nearly corresponds with an increase of 26% growth in shipments year-on-year.

overall growth of the global PC market was 12.5 percent.

Apple will reveal its numbers on 25 July at its quarterly earnings conference call. In addition to selling releasing Mac unit sales should also be discussing the iPhone for two days last June.

No matter how you slice it, these numbers are good news for the Mac fraternity who have been somewhat concerned about the last few years can be turned Apple into a music company more money than (the fact that fuel reduced computer company Apple "Computer" from its name recently, deciding to go with "Apple Inc" instead).

However, with computer sales growth of over three times the market Apple is being shared.

What makes these numbers even more impressive is the fact that all the other PC vendors in the vending machines at the site much more different price points than Apple offers. With the iPhone too

Market Share – How to Calculate it

Rarely, I come across someone who tends to leave a lasting impression on me because they think logically and write incisive.

Estelle Metayer one of these people. Her insights and thinking in higher marketing and information about our competitors are very powerful. But his ability to translate these concepts to implement changes on day-to-day what makes it such a powerful communicator. Dear, maybe I'm in love!

In any case, here's a two part adaptation of his article on how to calculate market share. To say that, this has helped me very much is not enough.

Have you ever been in a situation where your competitors to claim market share was not even close to the calculations that you gave to your senior managers? Or where people differ in the organization will use different numbers? Where annual reports claimed market shares were not able to go back in your calculations? Understand how you can calculate - and use - market share can be extremely useful.

This article will discuss some of the techniques you can apply when dealing with a market share calculations:

Why is proper accounting of market share so important?

Define your market share according to your objectives;

Market share calculations and pitfalls to avoid;

How to calculate market share when no data is available.

Why is proper accounting of market share so important?

As a marketing manager at Starbucks described in an excellent article about market share in the retail world, the basic themes typically include any, or all, of the following:

Market potential - "How dollars in this market for my concept?"

Market share - "How much of the potential in the market I continue?"

Market Opportunity - "Which markets offer the greatest opportunity for growth?" But market share calculations can also serve other purposes. Can be used to:

Challenge common wisdom One of my clients in electronic company consistently claimed his company owned 80% of the world market in its segment. However, we soon noticed that the accounting team and was responsible for maintaining the market share calculations, up to date, using the following method to reach their calculations:

Number of contracts won / number of contracts follow

Because the company only after half of the total available contracts, this measure not convey an appropriate picture of reality - namely that the company owned really less than 50% of the total market.

Avoid blind spots and avoid looking for substitutes: Imagine yourself as a marketing manager for Coca-Cola. What is your market share? Approximately 60% of the world market against Pepsi? Not really. Coca-Cola management will not only include the direct competitors in their (Pepsi) market share, they can also include soft drinks (Sprite, juice, etc.) or even any Food and Drink products destined to cool down a dry throat. For example, can include ice cream. This approach enables the company to include alternative products / lifestyles in order to avoid blind spot - a new trend or product reaches the market, such as increased use of smoothies, would not be tracked differently.

In the same vein, the makers of corn flakes only compete against one another? Or they will also compete against manufacturers of other ready to eat cereal? What about hot cereal? What about bacon and eggs?

Introduce common sheet to work: In many companies, a variety of market share calculations. Calculate calculate market share based on revenue; the marketing department uses the number of goods sold; the strategic planning department will look at the bigger picture, etc. As you can imagine easily, working ' The same set of numbers is useful. Will avoid confusion and conflicting messages (annual reports, discussions with journalists, etc.)

Estelle Metayer one of these people. Her insights and thinking in higher marketing and information about our competitors are very powerful. But his ability to translate these concepts to implement changes on day-to-day what makes it such a powerful communicator. Dear, maybe I'm in love!

In any case, here's a two part adaptation of his article on how to calculate market share. To say that, this has helped me very much is not enough.

Have you ever been in a situation where your competitors to claim market share was not even close to the calculations that you gave to your senior managers? Or where people differ in the organization will use different numbers? Where annual reports claimed market shares were not able to go back in your calculations? Understand how you can calculate - and use - market share can be extremely useful.

This article will discuss some of the techniques you can apply when dealing with a market share calculations:

Why is proper accounting of market share so important?

Define your market share according to your objectives;

Market share calculations and pitfalls to avoid;

How to calculate market share when no data is available.

Why is proper accounting of market share so important?

As a marketing manager at Starbucks described in an excellent article about market share in the retail world, the basic themes typically include any, or all, of the following:

Market potential - "How dollars in this market for my concept?"

Market share - "How much of the potential in the market I continue?"

Market Opportunity - "Which markets offer the greatest opportunity for growth?" But market share calculations can also serve other purposes. Can be used to:

Challenge common wisdom One of my clients in electronic company consistently claimed his company owned 80% of the world market in its segment. However, we soon noticed that the accounting team and was responsible for maintaining the market share calculations, up to date, using the following method to reach their calculations:

Number of contracts won / number of contracts follow

Because the company only after half of the total available contracts, this measure not convey an appropriate picture of reality - namely that the company owned really less than 50% of the total market.

Avoid blind spots and avoid looking for substitutes: Imagine yourself as a marketing manager for Coca-Cola. What is your market share? Approximately 60% of the world market against Pepsi? Not really. Coca-Cola management will not only include the direct competitors in their (Pepsi) market share, they can also include soft drinks (Sprite, juice, etc.) or even any Food and Drink products destined to cool down a dry throat. For example, can include ice cream. This approach enables the company to include alternative products / lifestyles in order to avoid blind spot - a new trend or product reaches the market, such as increased use of smoothies, would not be tracked differently.

In the same vein, the makers of corn flakes only compete against one another? Or they will also compete against manufacturers of other ready to eat cereal? What about hot cereal? What about bacon and eggs?

Introduce common sheet to work: In many companies, a variety of market share calculations. Calculate calculate market share based on revenue; the marketing department uses the number of goods sold; the strategic planning department will look at the bigger picture, etc. As you can imagine easily, working ' The same set of numbers is useful. Will avoid confusion and conflicting messages (annual reports, discussions with journalists, etc.)

GPS Brands Market Share Data for 2007

Garmin is king in the US, by a wide margin. In Europe, it's TomTom's World

According to new PND data, Garmin was the #1 GPS brand in the United States in 2007, and by a pretty comfy margin -- taking 47% of the total GPS market. TomTom ranked a distant second place with just 19 percent market share, followed closely by Magellan in third place.

Europe

In Europe, Dutch-based company TomTom enjoys the #1 spot with 38% market share. Garmin is a distant second with 19%, and Magellan isn't even in the game.

According to new PND data, Garmin was the #1 GPS brand in the United States in 2007, and by a pretty comfy margin -- taking 47% of the total GPS market. TomTom ranked a distant second place with just 19 percent market share, followed closely by Magellan in third place.

Europe

In Europe, Dutch-based company TomTom enjoys the #1 spot with 38% market share. Garmin is a distant second with 19%, and Magellan isn't even in the game.

Apple commands 25.3% US smartphone market share in Dec 2009

According to a recent ComScore report subscriber market share of U.S. mobile for December 2009, Apple's market share of U.S. smartphone increased by 1.2% to 25.3%. Blackberry maker Research In Motion (RIM) leads the category with 41.6% market share, while Apple's iPhone (25.3%) and Microsoft's Windows platform (18.0%) were second and third respectively after. Compared with the previous reporting period (September 2009), RIM and Microsoft each lost 1-percentage point in December 2009 period, while Palm-lost 2.2 percentage points in market share. mailed Apple and Google gained market share smartphone for the same period.

According to the report of the market's recent IDC, Apple shipped 25.1 million iPhones in 2009 capturing 14.4% of global smartphone market share.

In the overall US mobile market segment, Motorola ranked top with 23.5% market share, followed by LG (21.9%), Samsung (21.2%), Nokia (9.2%) and RIM (7.0%). Compared to previous reporting period (September 2009), Motorola and Nokia lost market share to Samsung, RIM and LG in December 2009.

The study says a total of 234 million people age 13 and older used mobile devices in December 2009 in the U.S.

According to the report of the market's recent IDC, Apple shipped 25.1 million iPhones in 2009 capturing 14.4% of global smartphone market share.

In the overall US mobile market segment, Motorola ranked top with 23.5% market share, followed by LG (21.9%), Samsung (21.2%), Nokia (9.2%) and RIM (7.0%). Compared to previous reporting period (September 2009), Motorola and Nokia lost market share to Samsung, RIM and LG in December 2009.

The study says a total of 234 million people age 13 and older used mobile devices in December 2009 in the U.S.

MONTHLY MARKET SHARE REPORTS

Trading is fragmenting between exchanges and competing venues. But by how much and which venues? Find out in our summarised monthly reports.

Monthly Data at a Glance

The charts below show the traded value of all European equities (in Euro € millions) recorded over the last 13 months. For the most recent month the break down for the main venues is provided. More detailed information by country or main index can be downloaded at the bottom of the page.. Summary information on European Dark Pool trading can be found by selecting the second tab. Selecting the Asia Pacific tab provides access to a spreadsheet for the Japanese market at present.

The market share information has been sourced from Thomson Reuters Market Share Reporter which uses data from individual trades reported by all European Exchanges, MTFs, and OTC trade reporting venues.

Monthly summarised data on a per market and index basis

These spreadsheets provide more detailed monthly data for European equities broken out by markets and index constituents. Download our guide as to how we compile these reports.

Monthly Data at a Glance

The charts below show the traded value of all European equities (in Euro € millions) recorded over the last 13 months. For the most recent month the break down for the main venues is provided. More detailed information by country or main index can be downloaded at the bottom of the page.. Summary information on European Dark Pool trading can be found by selecting the second tab. Selecting the Asia Pacific tab provides access to a spreadsheet for the Japanese market at present.

The market share information has been sourced from Thomson Reuters Market Share Reporter which uses data from individual trades reported by all European Exchanges, MTFs, and OTC trade reporting venues.

Monthly summarised data on a per market and index basis

These spreadsheets provide more detailed monthly data for European equities broken out by markets and index constituents. Download our guide as to how we compile these reports.

Snazzy pie chart shows the current state of high definition disc market

Nothing like a colorful pie chart to show the current position in the Blu-ray HD DVD fight against. Thanks to the Understanding and Solutions to deliver.

It shows (click on image for full size version) and Blu-ray is currently supported only by 53% and 25% HD DVD. The remaining 22% is attributed to Warner. From May, figures could be 75% -25% in favor of Blu-ray's.

These figures are the market share video based on Q1-Q3 2007 was U.S. retail value.

"As we stand today, Warner Bros. 'decision to move from its dual-format position has brought much needed clarity on the market and Blu-ray hand strengthened significantly. Looking forward, the next six months is crucial for the future of high definition discs. There is considerable market potential for packaged and format disk with 75% of Hollywood studio press just behind Blu-ray end of May 2008, the confusion over soon . We should see an end to the format war within the year, "said Jim Bottoms, Co-Managing Director Understanding and Solutions.

Disappointingly, however, that the whole concept of HD disc take years to catch on, and analysts predict that, by 2011, high-definition players in 36% of U.S. households, and only 11% of European.

It shows (click on image for full size version) and Blu-ray is currently supported only by 53% and 25% HD DVD. The remaining 22% is attributed to Warner. From May, figures could be 75% -25% in favor of Blu-ray's.

These figures are the market share video based on Q1-Q3 2007 was U.S. retail value.

"As we stand today, Warner Bros. 'decision to move from its dual-format position has brought much needed clarity on the market and Blu-ray hand strengthened significantly. Looking forward, the next six months is crucial for the future of high definition discs. There is considerable market potential for packaged and format disk with 75% of Hollywood studio press just behind Blu-ray end of May 2008, the confusion over soon . We should see an end to the format war within the year, "said Jim Bottoms, Co-Managing Director Understanding and Solutions.

Disappointingly, however, that the whole concept of HD disc take years to catch on, and analysts predict that, by 2011, high-definition players in 36% of U.S. households, and only 11% of European.

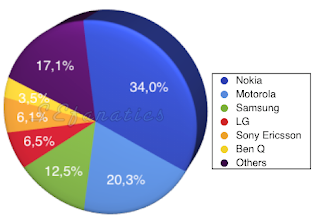

Sony Ericsson's market share

According to Gartner mobile phones demand grew 24% in Q1. Nokia still leads, but especially Motorola is expanding rapidly. The biggest loser is the Siemens (BenQ). Last year, Siemens shares were marked 5,7% and now only 3,5 percent! Still I'm not sure that BenQ-Siemens started to gain more market share this year.

Sony Ericsson is growing nicely! last year market share is 5.5% and now it's 6.1 percent. I hope that Sony Ericsson LG arrives!

Sony Ericsson is growing nicely! last year market share is 5.5% and now it's 6.1 percent. I hope that Sony Ericsson LG arrives!

The Apple Market Share Myth

According to proponents of this myth, a vendor’s market share numbers speak for themselves as a critically important factor in selecting a technology product or platform. They're wrong, here's why.

Why the Myth weaving

Market share is being used frequently spreads silent. It has been used by''n Apple Macintosh since its introduction over twenty years ago. Professional disagree-to say there has long insisted that Mac market share would be prevented from taking advantage of the limited economies of scale hardware was driving cheaper PCs, as well as extensive software development forces which present a wide range of various PC applications.

Ironically, those making the biggest stink about Apple historically low proportion of the overall PC market share has started to attack the majority of the iPod music player market. They are a joy to preach about the demise of the iPod because its market share down to 75% reporting of all music devices. If market share is so vitally important, why does the same analysts advise people to march to buy on the market leading iPod?

Clearly, this use of contradictory facts to suit their purposes indicates something wrong with the conclusions drawn from simple market share numbers. It also calls into question the credibility of those who use market share to make broad, sweeping generalizations.

Like most legends, there are elements of truth buried within the layers of misconceptions. Let's pull apart what the market is, how it can be misinterpreted, and how the numbers can easily be skewed to present false information.

Solving with Extreme Prejudice

The definition of market share is easy: it's a percentage of sales or specific vendor products within the overall market. Much more interesting, however, the actual definition of the market in question, or qualitative value of proportion given the market. These provide much more useful, and almost always glossed over when the number of market share base is being thrown around.

To begin, look at the figures Apple's share of the market historically. Actual numbers vary slightly depending on the source and methodology. In this article, I use consistent numbers from Gartner, and reference where and when the numbers are recorded.

In 1980, Gartner reported Apple's share of the global computer market is 15.8%. In 1996, they report Apple's shares as 4.6%. Last year, they reported market share Apple's at 2.2%. From those numbers, it would appear that once belonged to Apple extensive control over the PC world, and has been slipping ever since the pool of irrelevance. That is the story silent injectors like to be involved anyway. However, the numbers tell the story very useful without some consideration of their context.

Myth in the PC Market: 1980-1996

There was no PC in 1980, and was not Mac yet either. Computer makers are selling a product category, brand new, and the vibrant and diverse market for home and business computers including a wide range of machines made by various companies.

The market that Apple was fifteen percent share in 1980 was nothing like the market today. Only the early adopters of flame edge even purchase computers, and primarily as a novelty. Still, many more than five major manufacturers of computers, so a very significant portion of Apple compared its competitors.

Fifteen years later, Apple was just under 5% of the market. According to the WAG industry, this case Apple has failed to broadly license their operating system to other vendors. Instead, Microsoft has blossomed as the provider of DOS software for market dominant IBM PC compatible, and has just released a program for DOS and copied a lot of looks and feels Apple's Macintosh.

Windows 95 was delivered late; only arrived in recent days in 1995, so by 1996 there were a few months old. Had he managed to collect 95% of the market in less than a single year? Clearly not. Apple's market share has changed dramatically over the half decade before and not because Apple has slipped dramatically in popularity, but because the definition of the PC market has changed so significantly.

Between 1980 and 1996, floods in business PCs, replacing calculators, dumb terminals, and paperwork done in common by hand. Apple has made some ineffectual stabs at joining the business market, without much success.

In the early 80s, they are targeting businesses with the release of the Apple III, which upgrade their poorly built highly successful Apple II. Went nowhere, and Apple returns to construct new variations of their Apple II line, which continued to sell well for schools and home users.

Apple's next generation of computers, the Lisa and Macintosh, aimed at the business market is also exploding. Their unique software development requires significant new investment by developers, including new human interface guidelines mastered, much more than is necessary to create DOS apps simple.

The problems solved by the Mac's interface is clear value of new innovative graphic artists and designers, but less so for users who simply recording data, and of little benefit to any office worker drone that was simple , connecting with the main current as client dumb terminals.

Apple's Macs are so uniquely valuable for graphic designers that Apple overprice their hardware and software integrated product and still sell lots of them. Apple kept their big profit margins flush with cash, and enables them to further develop the Mac System Software, and work on new generations of products wizzy ideas as QuickTime and handheld Newton, and shares in the co-develop a range of achievements and failures: PowerPC, Taligent, OpenDoc, A / UX, among many others.

While Apple was profitable to sell as many Macs as they could build, flooding of generic, general purpose PCs are being used to serve markets quickly Apple was able or interested in entering. Apple would have been happy to sell Macs businesses running Microsoft Word and Excel applications, but businesses did not pay for software for Apple's innovative hardware premium. They want a cheap place, and before 1996, which usually means WordPerfect and Lotus 1-2-3 running on PC DOS base.

A low cost PC terminal with minimal functionality and stupid, but simple text interface that fits perfectly for the millions of office workers in cubes. Apple could have reduced their premium, innovative products to build PCs, but that would have thrown away Apples''first clear in profitability would have been forced to compete in a market with only about shaving the price of hardware goods.

Or, they could have tried to sell their Mac software to run on PCs instead of DOS, but this would have been a problem as well. They had to translate all their efforts developer PCs, with no general way to create binaries. That would, of necessity, kill their hardware sales profitable. NEXT trying this strategy and failed, even with their technology to provide binaries in general.

Now, PC DOS has low operating requirements, and no magic way to run a full operating system upgrade without considerable graphic. Who would this appeal to Mac software? There would be business users who did not want to invest in Macs have been far more likely to adopt Mac software if they would have asked in the same way to consolidate all their machines office workers' to do so.

The idea that Apple significantly Bwnglerodd control the PC world is simple and plausible sounding bit of hindsight speculative. If IBM could not deliver and establish OS / 2 machines on their own, how could Apple have? He tried the next two nextstep Sun Solaris to enter the PC operating system market, but failed to get any traction for the same reasons: computers in the early 1990s is crap that could barely run a graphical operating system.

Myth in the PC Market: 1996-2006

During the ten years following Windows 95's release, the Mac market share will appear to come from 5% to 2%, but the numbers are similarly betrayed truth without considering some context. Apple is quite obviously doing better today, and has a more prosperous for the future than they had in 1996, when they were at their lowest point of operational, technical, and strategic failure ever. How is it possible that they now receive less than half their 1996 market share?

Before 1996, the PC market has already grown to include a number of market segments was little to do with Apple, as noted above. So, while their share of the overall PC market is useful in comparing the performance of Apple to IBM, Dell, or Compaq, it is not relevant when considering the value or utility of Apple's product or platform.

If Apple had tried to build a Windows computer, or to compete against Windows as an operating system on PC hardware, the overall PC market share numbers that are relevant, but not Apple. Here is why.

Microsoft management, with some difficulty, to move DOS to Windows users in the second half of 1990 through tightly bundled DOS into Windows 95. That killed any competition from other versions of DOS, while also making it no more expensive to run Windows 95: it was free with every new PC.

This is another example of Microsoft software exclusive bundling to cheat the market by wielding price as a competitive weapon against commercial alternatives without actually reducing their own prices. This is exactly the kind of monopoly was the U.S. history of struggle, but Microsoft managed to avoid enforcement of laws against predatory pricing until their situation so completely that he could not effect any competitors in the market.

So, not only has the hardware side of PC market growing to include areas far beyond competing in the Apple market, but the software side of the PC market has failed completely to act as the free market. The failure of the U.S. Justice Department to uphold the law has served effectively turn Windows, the software side of the PC market, into a government-sponsored monopoly.

Monopoly is not only a high market share, but rather a unique situation with the ability to treat the market to prevent the natural balance created by competition. By killing the markets for DOS and Windows alternatives, Microsoft continues to enjoy fat profits without having to lower their prices software: there were no competitors!

Low cost PC hardware attached to the costly software license Windows to create a market where the demand for close alternatives to Microsoft's software masked by price dumping: potential competitors were competing against what appears to be a free product free.

The next time you hear a market share numbers being thrown around, considering the context. Numbers do not speak for themselves, they require interpretation key. Next up: more nails in the coffin of the Apple Market Share Myth: The number of slippery, quality vs. quantity, market definitions, and a closer look at the iPod market share: Market Share Myth: focus!

Why the Myth weaving

Market share is being used frequently spreads silent. It has been used by''n Apple Macintosh since its introduction over twenty years ago. Professional disagree-to say there has long insisted that Mac market share would be prevented from taking advantage of the limited economies of scale hardware was driving cheaper PCs, as well as extensive software development forces which present a wide range of various PC applications.

Ironically, those making the biggest stink about Apple historically low proportion of the overall PC market share has started to attack the majority of the iPod music player market. They are a joy to preach about the demise of the iPod because its market share down to 75% reporting of all music devices. If market share is so vitally important, why does the same analysts advise people to march to buy on the market leading iPod?

Clearly, this use of contradictory facts to suit their purposes indicates something wrong with the conclusions drawn from simple market share numbers. It also calls into question the credibility of those who use market share to make broad, sweeping generalizations.

Like most legends, there are elements of truth buried within the layers of misconceptions. Let's pull apart what the market is, how it can be misinterpreted, and how the numbers can easily be skewed to present false information.

Solving with Extreme Prejudice

The definition of market share is easy: it's a percentage of sales or specific vendor products within the overall market. Much more interesting, however, the actual definition of the market in question, or qualitative value of proportion given the market. These provide much more useful, and almost always glossed over when the number of market share base is being thrown around.

To begin, look at the figures Apple's share of the market historically. Actual numbers vary slightly depending on the source and methodology. In this article, I use consistent numbers from Gartner, and reference where and when the numbers are recorded.

In 1980, Gartner reported Apple's share of the global computer market is 15.8%. In 1996, they report Apple's shares as 4.6%. Last year, they reported market share Apple's at 2.2%. From those numbers, it would appear that once belonged to Apple extensive control over the PC world, and has been slipping ever since the pool of irrelevance. That is the story silent injectors like to be involved anyway. However, the numbers tell the story very useful without some consideration of their context.

Myth in the PC Market: 1980-1996

There was no PC in 1980, and was not Mac yet either. Computer makers are selling a product category, brand new, and the vibrant and diverse market for home and business computers including a wide range of machines made by various companies.

The market that Apple was fifteen percent share in 1980 was nothing like the market today. Only the early adopters of flame edge even purchase computers, and primarily as a novelty. Still, many more than five major manufacturers of computers, so a very significant portion of Apple compared its competitors.

Fifteen years later, Apple was just under 5% of the market. According to the WAG industry, this case Apple has failed to broadly license their operating system to other vendors. Instead, Microsoft has blossomed as the provider of DOS software for market dominant IBM PC compatible, and has just released a program for DOS and copied a lot of looks and feels Apple's Macintosh.

Windows 95 was delivered late; only arrived in recent days in 1995, so by 1996 there were a few months old. Had he managed to collect 95% of the market in less than a single year? Clearly not. Apple's market share has changed dramatically over the half decade before and not because Apple has slipped dramatically in popularity, but because the definition of the PC market has changed so significantly.

Between 1980 and 1996, floods in business PCs, replacing calculators, dumb terminals, and paperwork done in common by hand. Apple has made some ineffectual stabs at joining the business market, without much success.

In the early 80s, they are targeting businesses with the release of the Apple III, which upgrade their poorly built highly successful Apple II. Went nowhere, and Apple returns to construct new variations of their Apple II line, which continued to sell well for schools and home users.